Metrofintech – Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professional fund managers, who make investment decisions on behalf of the investors.

Here are some key features and aspects of mutual funds:

Diversification: One of the main advantages of mutual funds is diversification. By pooling money from various investors, a mutual fund can spread its investments across a wide range of assets. This helps reduce the risk associated with individual stocks or bonds.

Professional Management: Mutual funds are managed by experienced fund managers who analyze market trends, research securities, and make investment decisions. Investors benefit from the expertise of these professionals, especially those who may not have the time or knowledge to manage their own investments.

Liquidity: Mutual fund shares can be bought or sold on any business day, providing investors with liquidity. The price at which investors buy or sell mutual fund shares is determined by the net asset value (NAV), which is calculated at the end of each trading day.

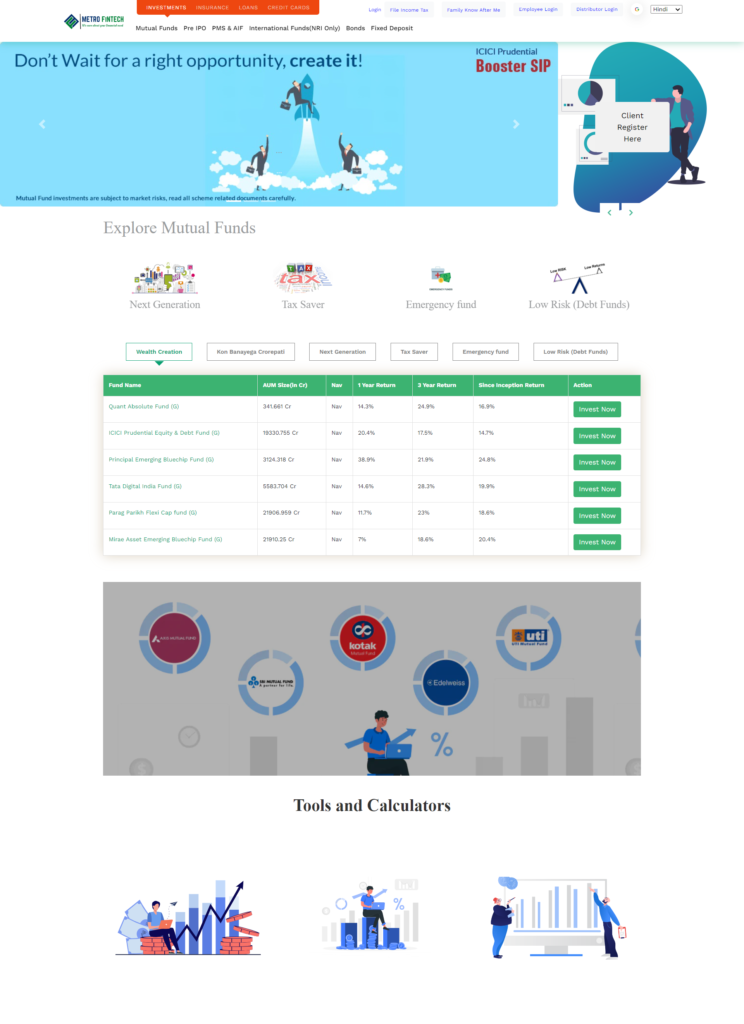

Variety of Funds: Mutual funds come in various types, including equity funds (investing in stocks), bond funds (investing in bonds), money market funds (investing in short-term, low-risk instruments), and hybrid funds (mix of stocks and bonds). Investors can choose funds based on their risk tolerance, investment goals, and time horizon.

Fees: Investors may incur fees when investing in mutual funds. Common fees include the expense ratio (the cost of managing the fund), sales loads (fees associated with buying or selling shares), and redemption fees (charged when investors sell shares shortly after purchasing them). It’s important for investors to be aware of these fees and consider their impact on returns.

Performance: Mutual fund performance is measured by its returns over time. Past performance is not indicative of future results, but it can provide insight into the fund manager’s track record. Investors often review a fund’s historical performance before making investment decisions.

Minimum Investment: Many mutual funds have a minimum investment requirement, which is the minimum amount of money an investor needs to invest in the fund. Some funds may have higher minimums than others.

Before investing in mutual funds, it’s crucial for investors to assess their financial goals, risk tolerance, and investment time horizon. Additionally, researching the specific mutual funds, understanding their investment objectives, and reviewing their historical performance can help investors make informed decisions.